Introduction

Creating a finance website in 2025 demands more than just data and charts — it needs trust-building design, mobile-first performance, intuitive navigation, and strong brand positioning. Below, we list the top 9 finance websites of 2025 that have mastered these essentials. Whether you’re a fintech startup, investment firm, or personal finance blogger, these examples will help inspire your next project.

9 Best Finance Designs to Checkout

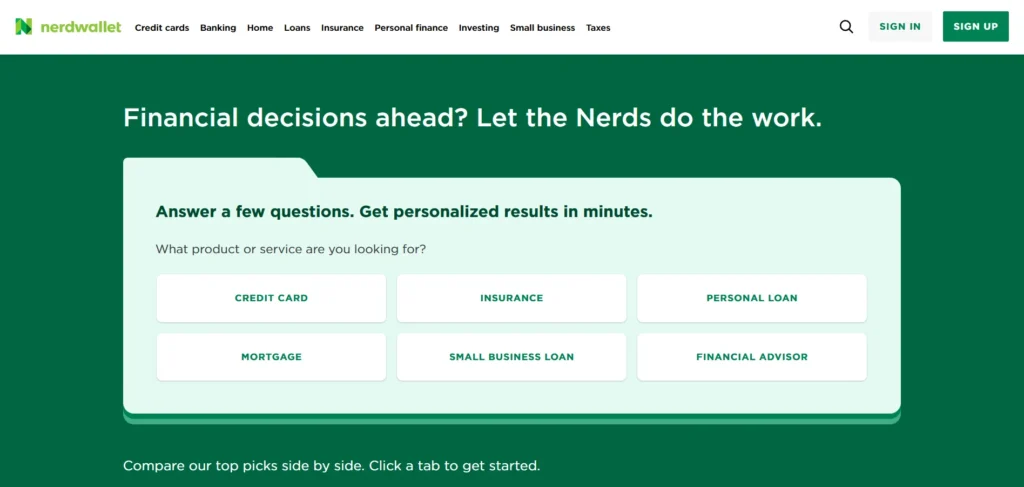

NerdWallet continues to dominate in 2025 as one of the most reliable and user-friendly personal finance websites. With its clean UI, interactive tools, and helpful comparison charts, it empowers users to make smarter financial decisions. The use of well-structured blog content, SEO-rich reviews, and calculators makes it a go-to resource for credit cards, mortgages, and investing.

Robinhood’s website offers an excellent blend of modern design and powerful fintech features. It uses strong visual hierarchy, compelling CTAs, and seamless mobile integration. The homepage delivers clarity about investing, crypto, and retirement in a single scroll, making the platform accessible even to first-time investors.

Morningstar excels with its in-depth analytics and professional-grade investment research. The site is designed for both amateur and professional investors. In 2025, their enhanced data dashboards and AI-driven recommendations stand out. The structured data presentation with customizable reports makes it a powerful platform for finance professionals.

Mint remains a favorite for personal budgeting and financial tracking. With simple account syncing and powerful data visualization tools, the site delivers real-time insights into your finances. The UI focuses on clarity and ease of use, making budgeting stress-free for users of all skill levels.

SoFi continues to evolve as a comprehensive financial ecosystem. From student loans to investing and insurance, the site’s modern and minimalist interface is backed by rich educational resources. Their homepage smartly funnels visitors into product categories with bold CTAs and crisp navigation.

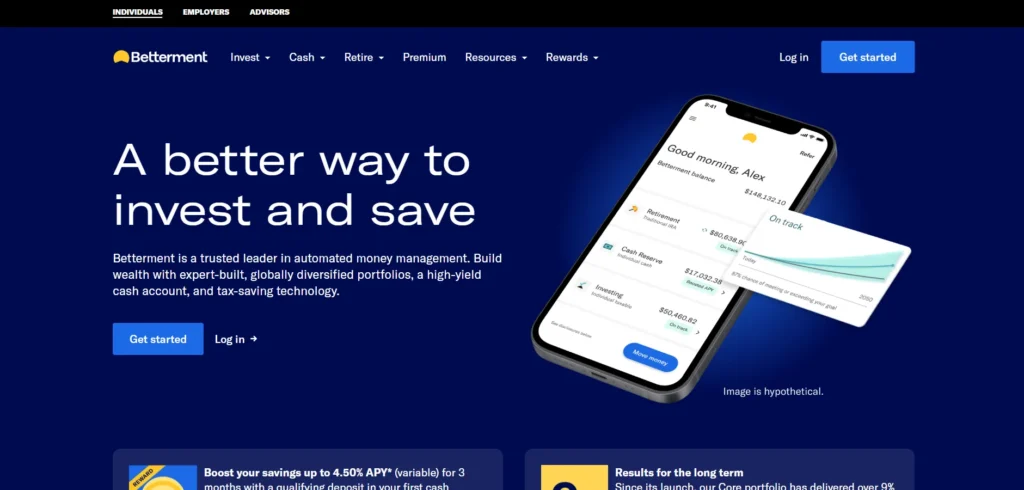

Betterment is leading in robo-advisory with a user-centric web design that simplifies investment decisions. Their 2025 website emphasizes trust through testimonials, secure integrations, and transparent fee breakdowns. The onboarding experience is interactive and highly tailored.

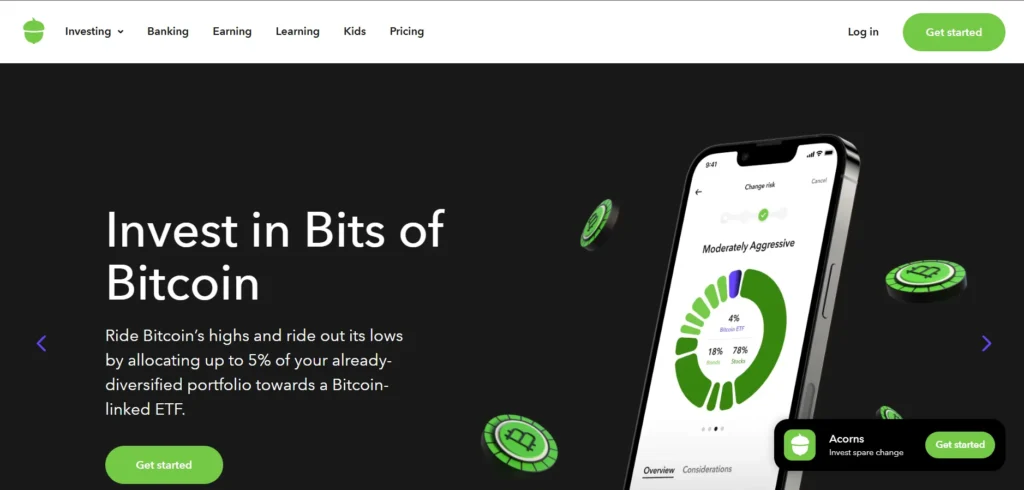

Acorns focuses on micro-investing with a clean and vibrant website design aimed at younger audiences. The storytelling approach and use of animations on scroll help demystify investing. Their educational content, blog, and tools are seamlessly integrated with a slick UX.

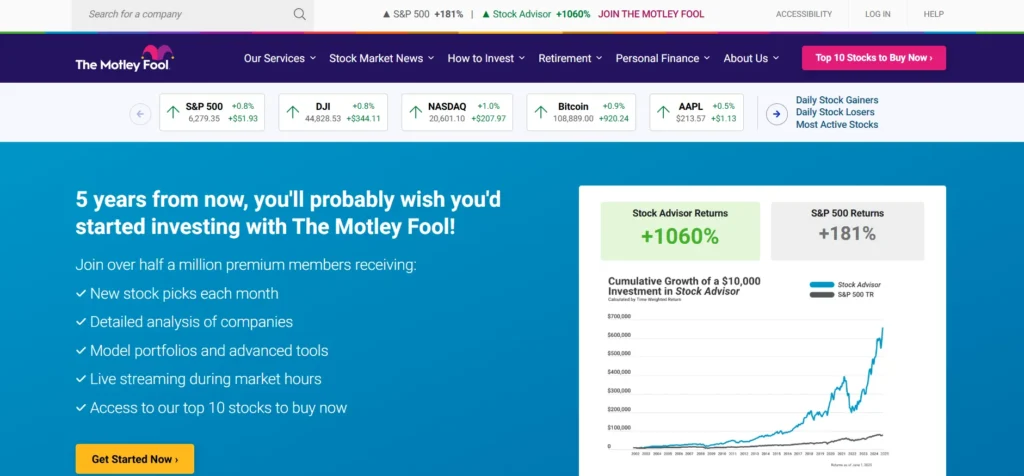

The Motley Fool remains a giant in financial education and stock recommendations. Their homepage in 2025 is content-rich, yet well-organized, featuring top picks, newsletters, and premium insights. The consistent use of trust signals and social proof boosts user confidence.

Bankrate provides authoritative financial product comparisons—from mortgage rates to auto loans. The site uses clear typography, simple calculators, and expert-backed content. In 2025, it’s still a gold standard for SEO-driven finance content and monetization via affiliate partnerships.

Conclusion

In 2025, the best finance websites are user-first, mobile-optimized, content-rich, and conversion-focused. From budgeting apps to investment research tools, these platforms use strategic design and SEO-driven content to offer value while building trust. Whether you’re launching a new financial platform or redesigning your existing one, these top finance websites provide all the inspiration you need.

Frequently Asked Questions (FAQs)

What makes a finance website successful in 2025?

A finance website succeeds when it offers clear navigation, real-time data, strong security measures, mobile responsiveness, and SEO-rich educational content.

How do finance websites earn revenue?

They often earn through affiliate marketing, subscription plans, ads, robo-advisory fees, and financial product partnerships.

Why is UX important in finance websites?

Good UX increases trust and engagement, essential for financial platforms where users share sensitive information and make important decisions.